Credit Union Cheyenne: Remarkable Member Providers and Financial Products

Credit Union Cheyenne: Remarkable Member Providers and Financial Products

Blog Article

Credit Rating Unions: A Smart Choice for Financial Flexibility

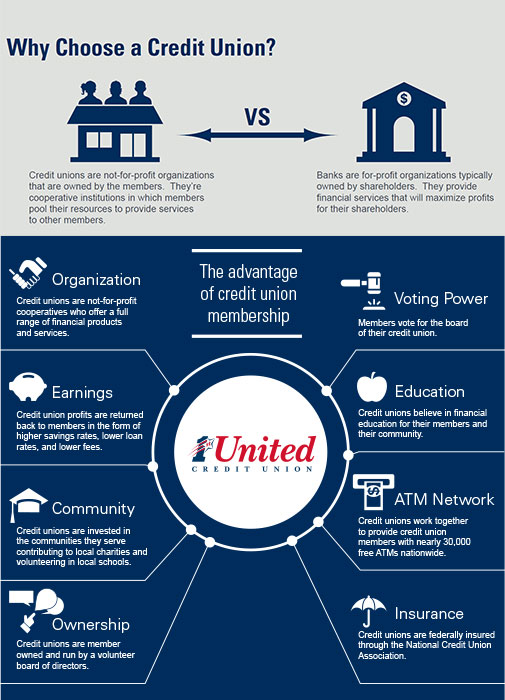

In a world where monetary choices can dramatically influence one's future, the choice of where to entrust your money and financial well-being is crucial. By stressing personalized services, affordable prices, and a sense of community, credit unions stand out as a smart option for those looking for financial freedom.

Benefits of Joining a Credit Rating Union

When taking into consideration banks to sign up with, people might locate that lending institution provide special advantages that advertise economic freedom. One significant advantage of lending institution is their emphasis on participant complete satisfaction as opposed to solely on earnings. As member-owned companies, cooperative credit union focus on the needs of their members, often using even more tailored solutions and a stronger feeling of community than standard financial institutions.

Additionally, credit scores unions generally offer competitive rates of interest on savings accounts and financings. This can lead to greater returns on cost savings and lower borrowing expenses for members contrasted to bigger monetary establishments (Wyoming Credit Unions). By supplying these positive rates, cooperative credit union help their participants accomplish their economic objectives more effectively

An additional advantage of lending institution is their commitment to economic education. Lots of debt unions use workshops, seminars, and on the internet resources to assist participants boost their monetary literacy and make notified choices about their money. This concentrate on education and learning encourages people to take control of their finances, ultimately bring about higher monetary liberty and protection.

Reduced Costs and Better Rates

Signing up with a credit rating union can lead to lower costs and much better prices for members looking for financial solutions. Furthermore, debt unions are understood for supplying affordable rate of interest rates on cost savings accounts, fundings, and credit history cards. By maintaining charges reduced and prices affordable, credit history unions intend to help their participants save money and achieve their monetary objectives extra properly.

When it pertains to obtaining money, lending institution frequently provide extra favorable terms than banks. Participants might take advantage of lower rate of interest rates on lendings for numerous purposes, including auto finances, mortgages, and personal car loans. These reduced rates can lead to substantial long-lasting financial savings for consumers. By picking a credit scores union for economic solutions, people can make use of these cost-saving advantages and enhance their general financial well-being.

Individualized Customer Support

Credit score unions differentiate themselves from typical banks by giving individualized customer care tailored to the individual requirements and preferences of their members. This customized strategy collections cooperative credit union apart in the economic industry, as they prioritize developing solid partnerships with their members. You are extra than just an account number; you are a valued participant of a community-focused establishment. when you stroll into a credit score union.

Among the key elements of tailored customer service at lending institution is the capability to speak straight with experienced team who are bought aiding you accomplish your economic goals. Whether you are seeking to open up a new account, obtain a finance, or look for monetary suggestions, lending institution agents are there to supply assistance every action of the way (Credit Union in Cheyenne Wyoming). This individualized touch reaches numerous solutions, such as monetary planning, financial obligation loan consolidation, and even support during times of monetary challenge. By understanding your distinct scenarios, cooperative credit union can use solutions that are tailored to your details demands, promoting an extra favorable and encouraging banking experience.

Neighborhood Involvement and Assistance

Emphasizing their commitment to local areas, cooperative credit union proactively engage in area participation and support campaigns to foster financial development and monetary literacy. By taking part in regional events, sponsoring community programs, and sustaining philanthropic organizations, lending institution show their view publisher site commitment to the health of the locations they serve. These organizations often prioritize partnerships with regional businesses and organizations to stimulate economic advancement and produce chances for neighborhood members.

With financial education and learning workshops, lending institution furnish individuals with the knowledge and skills needed to make enlightened decisions regarding their funds. In addition, they provide sources such as budgeting tools, interest-bearing accounts, and inexpensive finance alternatives to assist community participants achieve their financial objectives. By fostering a society of financial literacy and empowerment, lending institution play an important function in reinforcing communities and advertising financial stability.

In addition, lending institution often collaborate with schools, charitable organizations, and federal government firms to supply economic education and learning programs customized to particular neighborhood requirements. This collaborative technique ensures that individuals of all histories and ages have accessibility to the resources and assistance necessary to develop a protected monetary future.

Financial Education And Learning and Resources

In accordance with their dedication to community participation and support, lending institution prioritize providing financial education and sources to encourage individuals in making informed monetary choices. By using workshops, seminars, online resources, and one-on-one therapy, credit scores unions aim to enhance their members' monetary literacy and capabilities. These academic initiatives cover a broad range of subjects, consisting of budgeting, conserving, spending, credit score administration, and debt repayment approaches.

Monetary education equips people with the understanding and skills required to browse complex monetary landscapes, bring about boosted economic wellness and security. Through accessibility to these sources, individuals can create sound cash monitoring practices, prepare for the future, and work in the direction of accomplishing their monetary objectives.

In addition, lending institution usually work together with neighborhood institutions, area facilities, and various other companies to increase the reach of economic education and learning programs. By involving with diverse target markets and advertising financial proficiency at the grassroots degree, cooperative credit union play an essential duty in fostering a monetarily notified and empowered society.

Conclusion

Finally, lending institution supply numerous advantages such as lower charges, far better rates, personalized client service, community assistance, and monetary education and learning - Credit Union Cheyenne WY. By prioritizing participant contentment and monetary empowerment, cooperative credit union function as a wise option for people looking for financial liberty and security. Joining a lending institution read this article can assist people conserve cash, accomplish their monetary goals, and develop a solid financial future

When considering economic establishments to join, people may find that credit score unions offer distinct benefits that advertise financial flexibility. By choosing a credit score union for economic solutions, individuals can take benefit of these cost-saving benefits and enhance their overall economic health.

In line with their dedication to area participation and assistance, credit score unions prioritize supplying monetary education and resources to encourage people in making informed economic decisions. By prioritizing participant complete satisfaction and economic empowerment, credit score unions serve as a try here wise option for people looking for financial freedom and security. Signing up with a debt union can assist people conserve money, achieve their financial objectives, and build a solid economic future.

Report this page